Flooring Adhesive Market Size and Forecast 2024 to 2034

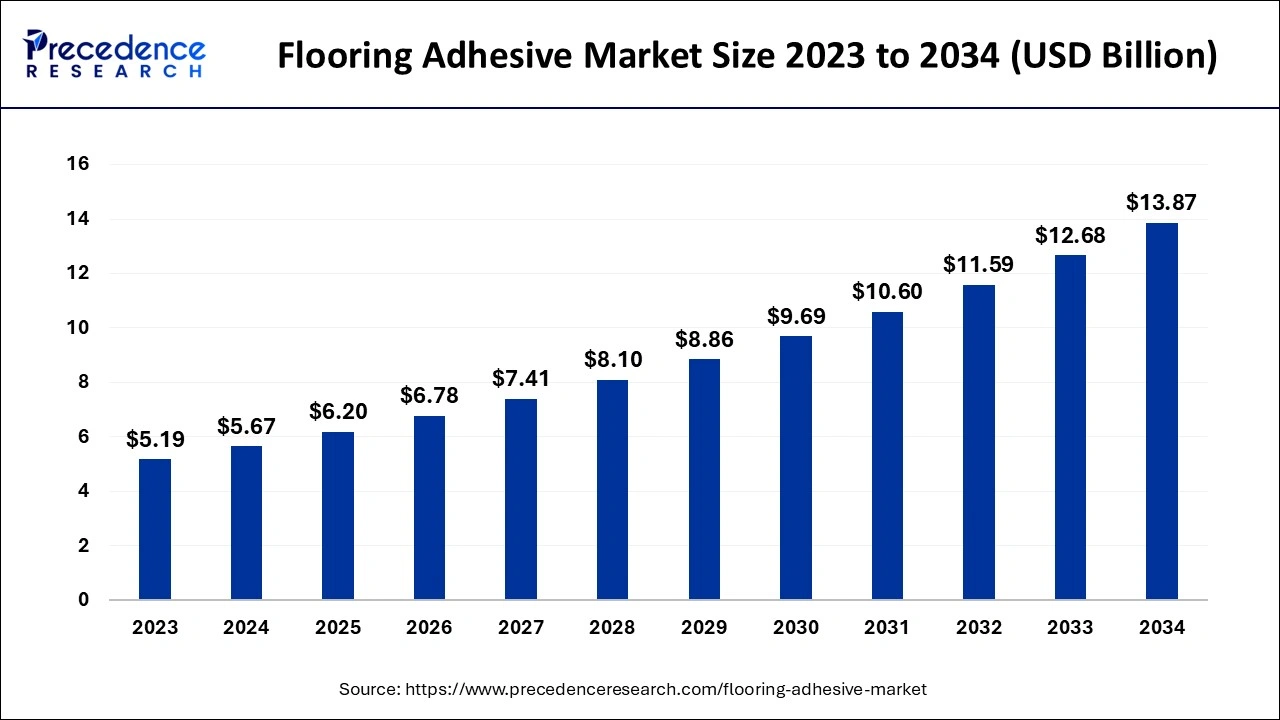

The global flooring adhesive market size is calculated at USD 5.67 billion in 2024 and is predicted to reach around USD 13.87 billion by 2034, expanding at a CAGR of 9.36% from 2024 to 2034. The rising need to inculcate durable, strong, and long-lasting bonds between tiles and substrates is increasing the adoption of the flooring adhesive market.

Flooring Adhesive Market Key Takeaways

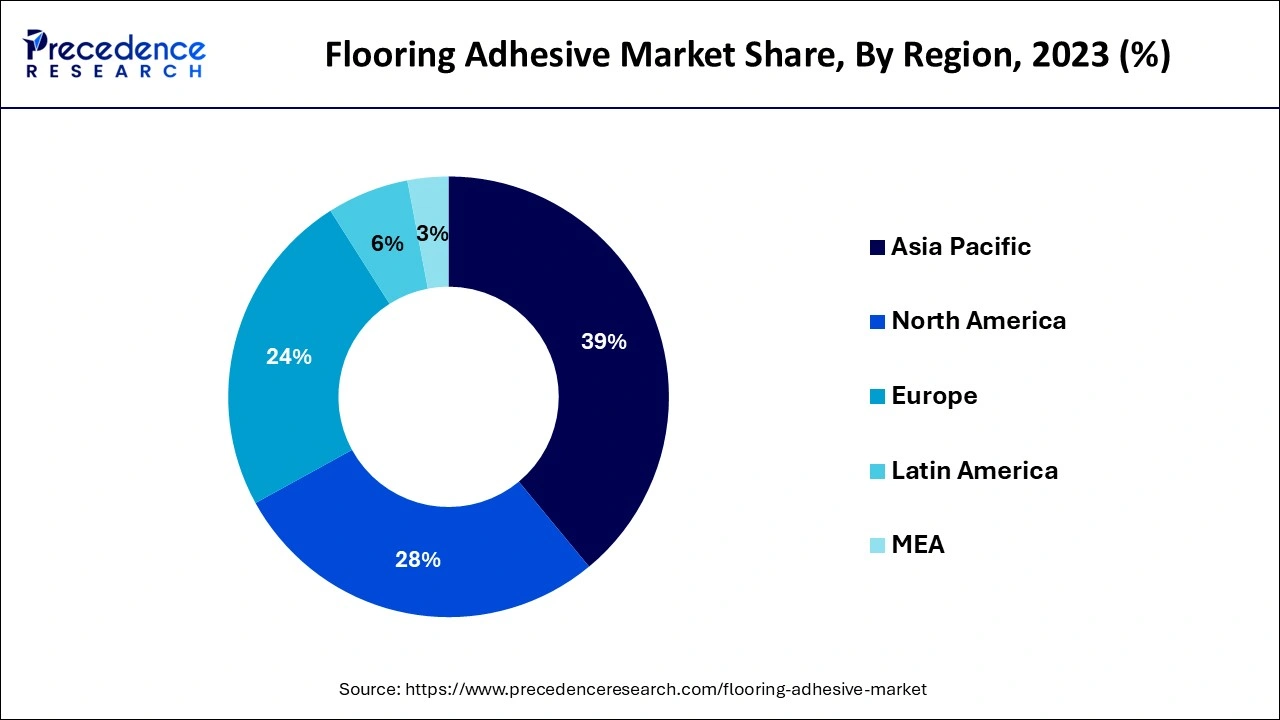

- Asia Pacific dominated the global market with the largest market share of 39% in 2023.

- North America is anticipated to grow significantly during the forecast period.

- By resin, the acrylic segment contributed the largest market share of 42% in 2023.

- By resin, the Polyvinyl Acetate segment is anticipated to grow at the fastest CAGR of 10.22%during the projected period.

- By application, the resilient flooring segment contributed the highest market share of 53% in 2023.

- By application, the wooden flooring segment is expected to show the fastest CAGR of 9.73% from 2024 to 2034.

- By end-use, the commercial segment captured the biggest market share of 35% in 2023.

- By end-use, the residential segment is anticipated to grow at the fastest CAGR during the forecast period.

How is AI changing the Flooring Adhesive Market?

The integration of artificial intelligence (AI) in the flooring adhesive market offers a transformation in lifestyle and business. AI in the adhesive and sealant industry provides software solutions that formulate adhesives to improve service to customers, improve efficiency, and optimize material flows and workflows.

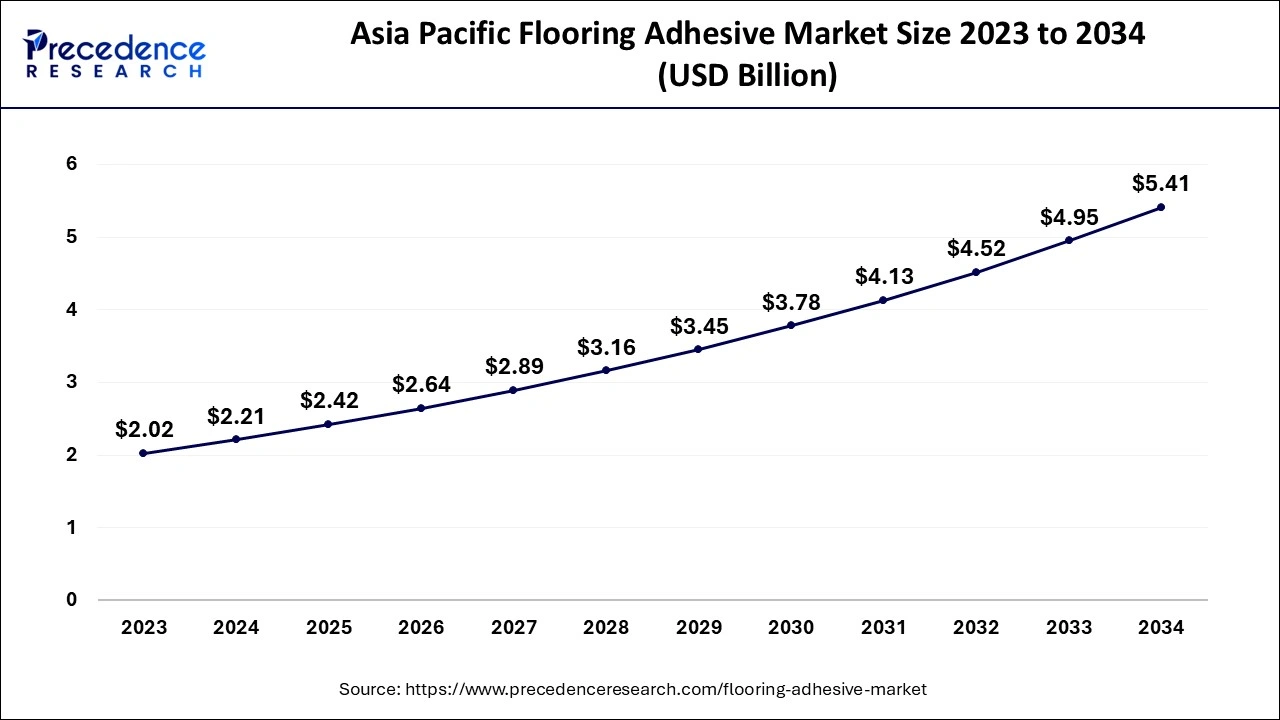

Asia Pacific Flooring Adhesive Market Size and Growth 2024 to 2034

The Asia Pacific flooring adhesive market size is exhibited at USD 2.21 billion in 2024 and is expected to be worth around USD 5.41 billion by 2034, growing at a CAGR of 9.37% from 2024 to 2034.

Asia Pacific dominated the global floor adhesive market in 2023. The dominance of this region is noted owing to Increasing urbanization and rising disposable incomes. The surge in urbanization represents the increasing opportunities for businesses in the region. This rapid pace of urbanization has significantly influenced the construction industry. As cities expand, the population migrates from rural to urban areas, which increases the demand for infrastructure, housing, and related materials.

- Asia Pacific includes 18 megacities, which is expected to demonstrate over a 50% increase in disposable income per capita by 2033.

North America is anticipated to grow significantly in the flooring adhesive market during the forecast period of 2024 to 2034. The growth of the market in this region is attributed to continuous consumer interest in home improvement projects such as kitchen and bathroom remodeling. Frequently used to replace older or worn flooring. United States has a wide availability of polyvinyl acetate (PVA) adhesive used for porous materials such as wood, paper, and cloth. Additionally, the region has rising commercial building construction, boosting the demand for vinyl, ceramic, and carpet tile products.

Market Overview

Flooring adhesive is a material that functions as a fastening agent to stick two or more solid materials by using glue, cement, or other adhesives. The floor adhesives prevent tiles from shifting or cracking while being walked on or placing a heavy object on. Compared to conventional mortar, flooring adhesive helps to minimize overall effort, time, and expenses. There are 5 different types of floor adhesive catering to specific requirements in the construction process. Moreover, they are extremely useful in ensuring a strong, long-lasting bond between the tiles and the substrates underneath.

Flooring Adhesive Market Growth Factors

- Flooring adhesive provides excellent bonding strength and durability. This ensures that the tiles are not loose, shifting, or detached when used. Additionally, they as extremely essential in areas with denser foot traffic and places vulnerable to damage from moisture.

- Floor adhesive is a great material to use on the kitchen and bathroom floors as they have a high level of water resistance which helps in fixing tiles in moisture-laden areas.

- The easy-to-use application makes it convenient to use. They are packaged in ready-to-use form which avoids extensive mixing and preparation of mortar cement.

- Tile fixing is one of the more expensive parts of the construction project. However, when the right adhesive is chosen, costly prices can be eliminated, such as admixtures, mortar cement, and labor costs. Additionally, there is no repair and replacement cost.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 13.87 Billion |

| Market Size in 2024 | USD 5.67 Billion |

| Market Size in 2025 | USD 6.20 Billion |

| Market Growth Rate from 2024 to 2034 | CAGR of 9.36% |

| Largest Market | Asia Pacific |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | Resin, Application, End-Use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, and Africa |

Market Dynamics

Driver

The demand in the construction industry

The flooring adhesive market services are highly demanded in construction flooring sectors such as education, retail, and industrial. Adhesives have an extremely versatile role in buildings and construction. Traditional and newly developed construction materials, such as concrete, plastics, wood panels, and much more, need adhesive to have high-quality adhesion, improve performance, and easier application. These benefits are increasing the demand for floor adhesives in the construction industry.

Restraint

Adhesive failure

When the adhesive does not bond properly to the substrate, it happens due to dampness in the subfloor, a curing compound on the surface, or weak material or dust on the surface; this results in the failure of the flooring adhesive market. The common cause of failure is the late placement of sheets. To avoid this problem, a simple thing can be done to prevent the adhesive from drying or setting. Using the wrong adhesive can also lead to this problem, which results in worn or incorrectly-sized notched trowel.

Opportunity

Infrastructure in economic development

The flooring adhesive market has a promising future in the development of infrastructure and economic growth. Infrastructure development is the milestone of economic growth and social progress. The regions with rapid urbanization and economic expansion require robust infrastructure to achieve the development goal. The goals can be supported by facilitating trade and commerce, attracting domestic and foreign investments, improving the quality of life for residents by providing essential services, and promoting sustainable development.

Resin Insights

The acrylic segment contributed the largest share of the flooring adhesive market in 2023. The dominance of this segment is noted due to its broad utility, which includes primed metals, direct-to-metal, wood, and masonry. Acrylic adhesives are available in a variety of colors and gloss levels. The Superior water-based acrylic floor adhesive is used for resilient tiles and sheets, wood parquet, linoleum, and carpets. It is best installed on concrete, chipboard, hardboard, plywood, and other types of sub-floors. The common applications of acrylics are wall panel bonding, grout sealing, textile bonding, paper stamps, leather tile envelopes, labels, and many more. To conclude, acrylic is a versatile material that is in high demand in various industries.

The Polyvinyl Acetate segment is anticipated to grow at a significant CAGR in the flooring adhesive market during the forecast period of 2024 to 2034. Polyvinyl Acetate adhesive is used mainly for interior applications. The growth of this segment is observed due to its high initial bonding strength and ease of use. They are available for both hot and cold pressing conditions and are suitable for various applications, such as lightweight panels, doors, foil lamination, and solid wood laminations. Additionally, PVA chips are added by applying a standard or moisture-removing primer coat and color coat, resulting in a chip system flooring.

Application Insights

The resilient flooring segment stood dominant in the flooring adhesive market in 2023. The dominance of this segment is due to its highly engineered sheet and tile products, which can withstand heavy use in a variety of commercial and residential buildings. They are firm, and bounce-back property makes them the preferred choice by healthcare and education designers. Compared to other flooring, resilient flooring offers a degree of flexibility under the foot, providing more comfort. Resilient floors are durable and last a long time, which saves money on replacement. Additionally, it reduces noise in places like schools and public places.

- In November 2024, Bona, a global leader in innovative floor care and maintenance solutions, collaborated with a color psychology expert to develop the Bona Resilient Solution Colour Collection.

The wooden flooring segment is anticipated to grow significantly in the flooring adhesive market during the forecast period of 2024 to 2034. Choosing the right flooring adhesive when it comes to wooden flooring is essential. Different types of woods respond better to varying adhesives. Solid wood requires more room to expand and contract with the atmospheric environment. These movements increase the chance of the flooring breaking. To prevent the floorboard from breaking, the right adhesive with great flexibility or elasticity is required. Some trusted brands for wooden flooring in the industry are Ardex, Bostik, Mapei, Tilemaster, and many more.

End-Use Insights

The commercial segment led the global flooring adhesive market in 2023. The dominance of this segment is observed due to the availability of a wide range of adhesives to use in commercial settings. There are various adhesives available, but only four are commonly used within the industry, such as epoxy, polyurethane, acrylic, and pressure-sensitive adhesives. The right floor adhesive should fulfill the environmental requirement intended and be labeled for commercial use. According to the standards, it should attain environmental and health requirements and prevent toxicity, hazardous ingredients, and volatile organic compounds (VOCs).

The residential segment is anticipated to grow at a significant CAGR in the market during the forecast period of 2024 to 2034. The expansion of the segment is noticed due to the rising number of houses that have been remodeled and renovated. According to the U.S. Census Bureau, the average U.S. home is 40 years old and increasing.

Flooring Adhesive Market Companies

- Bostik

- Dow

- Forbo Management SA

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- LATICRETE International, Inc.

- MAPEI

- Parker-Hannifin Corporation

- Pidilite Industries Ltd.

- Sika AG

Latest Announcements by Industry Leaders

- In June 2024, Magicrete MD Sourabh Bansal said, “In India, many people still rely on traditional methods like sand and cement for tile installation. While these methods have been in use for decades, they come with significant drawbacks, such as weak adhesion and tile breakage. Countries around the world have embraced tile adhesives, leading to widespread adoption and significant market penetration. However, in India, the penetration of tile adhesives remains at a modest 15 percent, highlighting a substantial opportunity for growth and modernization in the construction industry.”

Recent Developments

- In July 2024, Karta, a sustainable wood flooring specialist, launched a brand-new series of sustainable floors with 18 new, completely natural, plastic-free, and toxin-free floors. This new recycled leather series is made from leather offcuts sourced from the shoe industry. The aim is to continue providing innovative, high-quality, and eco-friendly solutions.

- In June 2024, Magicrete, a producer of AAC blocks, construction chemicals, and precast construction solutions, launched its latest tile adhesive product range. This modern construction technology in India contributes significantly to the ‘housing for all’ initiative through its innovative and affordable construction solutions.

Segments Covered in the Report

By Resin

- Acrylic

- Polyurethane

- Polyvinyl Acetate

- Others

By Application

- Resilient Flooring

- Wooden Flooring

- Laminate Flooring

- Others

By End-Use

- Residential

- Commercial

- Industrial

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa