A plumber has revealed the drastic actions he and his colleagues had to take to get paid as their employer teetered on the brink of collapse.

At the end of last month, news.com.au exclusively revealed that Victoria’s largest privately-owned plumbing contractor Richstone Group Pty Ltd had collapsed into liquidation.

All 150 of its employees lost their jobs on the spot and the company and seven related entities cumulatively owe $22.399 million to creditors, according to reports lodged with the corporate regulator.

David Coyne and Peter Krejci of insolvency firm BRI Ferrier are the appointed liquidators.

One employee, Jason*, who worked there for nearly a decade, said that Richstone Group’s financial woes were obvious to its employees as their pay was constantly late.

In response, staff went on strike, refusing to work until their paycheck had hit their bank accounts.

“If our pay isn’t in the bank by Friday morning, we don’t work,” the father-of-two told news.com.au.

“Every two weeks we’d sit in the (lunch) sheds and not work.

“Every Richstone employee would just be sitting in the sheds through no fault of our own until everyone got paid.”

Every two weeks, their pay was due, but although they would receive their payslips on time, the money didn’t come. Some workers whose banks took an extra day would also partake in the strikes, having been informed by their colleagues that the cash wasn’t coming.

Jason himself is owed $5000 in unpaid superannuation and, according to a statutory report lodged by the liquidator, employee liabilities are estimated to be $816,000.

Jason said he and his colleagues “held up everyone” on the building site, as plumbers are usually needed for the beginning stages of a job, whenever they went into the sheds.

This went on for two months before the plumbing company finally collapsed.

He said one builder “got jack of it” and refused to pay Richstone Group.

Another builder suggested paying the plumbers direct to stop all the hold-ups on their jobs, an offer the company turned down, news.com.au understands.

The plumbers used to make claims every month for the contract work they had done. However, by the end, Richstone Group encouraged plumbers to bill their clients every fortnight instead.

“We were having to make claims every two weeks to pay wages because they had nothing in the bank,” Jason said.

The company; s failure to pay also led to mass resignations in the months before it finally went bust, with many of the plumbers resigning for more stable income.

Know more or have a similar story? Get in touch | [email protected]

Richstone Group had been contracted to work on parts of Melbourne’s $12.6 billion Metro Tunnel Rail Project.

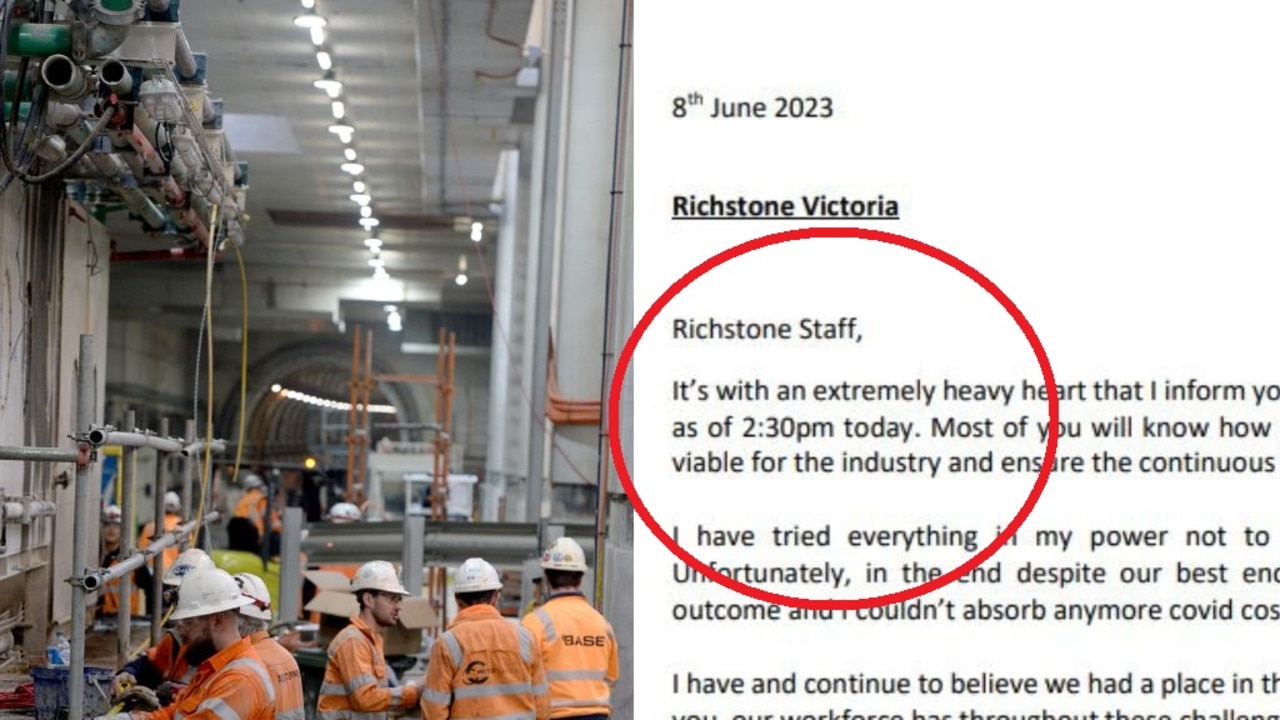

On June 8 at 2.30pm, workers were sacked on the spot.

In an email to staff, the company’s director, Shannon Egglestone, wrote that he had a “heavy heart” making the decision to put the company into liquidation and terminate all their employment.

“I have tried everything in my power not to add costs to the distressed projects. Unfortunately, in the end despite our best endeavours, the builders couldn’t support a viable outcome and I couldn’t absorb any more covid (sic) costs …,” Mr Egglestone wrote.

“I would like to thank you all for the great culture you have been part of and created. I and the rest of the company senior management wish you all the best in your next workplace.”

And just like that, Jason, who supports his wife and kids and has a mortgage, was unemployed.

A few weeks later, the liquidators sent a similar memo once the company had officially ceased to exist.

“I understand that your employment with the Companies was terminated on or about Thursday 8 June 20243,” their message read.

“If this is not the case, I advise that your employment is now terminated without notice upon the liquidation of the Companies, being 19 June 2023.”

According to liquidation documents, $16,000 is due to staff from unpaid wages, $8,800 and $6,800 in superannuation and salary sacrifice, and then a further $96,141 from annual leave and long service leave entitlements.

In total, employee liabilities are nearly $1 million.

The employees will qualify for a government compensation scheme called the Fair Entitlements Guarantee (FEG), which seeks to pay back staff caught up in a company collapse.

Unfortunately there is a cap on the amount of money that can be paid, making it unlikely staff will emerge from this ordeal entirely unscathed.

Unpaid wages and long service leave are only paid up to 13 weeks while only up to five weeks redundancy pay is offered.

Additionally, unpaid superannuation is not part of the FEG and therefore employees are unlikely to get a single cent back on that front.

There was just $61 left in the bank when liquidators took over the company.

On the company’s balance sheet, it appears to owe $5 million to the ATO.

However, liquidators said the ATO had submitted an even higher claim of $12.8 million, which could see Richstone’s debts climb even higher.

The firm’s total assets are estimated to be around $10 million and unsecured creditors are expected to receive between 0 and 15 cents for every dollar they are owed.

Liquidators sold the “majority” of the company’s assets for $4.8 million, in a sale that the Supreme Court of Victoria approved.

The liquidators said Richstone’s financial position “deteriorated significantly” from 2019 onwards.

By June 2020, it had racked up $16 million in deficits. But by the time of its collapse, this number had blown out to $50 million.

“Trade debtors decreased from $50 million as at 30 June 2020 to $2.6 million as at the date of our appointment, reflecting the company’s decline in trading performance during this period,” the report added.

The firm’s revenue went from $65 million in 2020 to just $25 million in the latest financial year, “which may reflect poorer market conditions, including the Covid-19 pandemic”.

Richstone Group appears to be another victim of Australia’s troubled building industry.

It attributed its failure to debts not being paid back in full as well as rising supply costs and increased market pressure.

Richstone Group had been in operation since 2003 prior to its collapse as a commercial plumber with large contracts to building companies including Maxcon and Hickory Construction.

Richstone Group had been contracted to work on parts of Melbourne’s $12.6 billion Metro Tunnel Rail Project.